-

Our Health Plans

show Our Health Plans menu

-

- About Our Plans

- Our Benefits

- My Health Pays Rewards®

- Coverage Area Map

- Ways to Save

- What is Ambetter Health?

- Shop and Compare Plans

- Find a Doctor

Use your ZIP Code to find your personal plan.

- See coverage in your area

- Find doctors and hospitals

- View pharmacy program benefits

- View essential health benefits

Find and enroll in a plan that's right for you.

-

-

Join Ambetter Health

show Join Ambetter Health menu

-

- Four easy steps is all it takes

- What you need to enroll

- Special Enrollment Information

-

-

For Members

show For Members menu

-

- Pay Now

- Find a Doctor

- Drug Coverage

- Forms and Materials

- Ways to Pay

- New Members

- Renew Your Plan

- Better Health Center

- The Better Bulletin

- Member News

- Health Savings Account

Find everything you need in the member online account

- View your claims

- Review your plan benefits

- Print your ID card

- View rewards points total

-

-

Our Health Plans

show Our Health Plans menu

-

- About Our Plans

- Our Benefits

- My Health Pays Rewards®

- Coverage Area Map

- Ways to Save

- What is Ambetter Health?

- Shop and Compare Plans

- Find a Doctor

Use your ZIP Code to find your personal plan.

- See coverage in your area

- Find doctors and hospitals

- View pharmacy program benefits

- View essential health benefits

Find and enroll in a plan that's right for you.

-

-

Join Ambetter Health

show Join Ambetter Health menu

-

- Four easy steps is all it takes

- What you need to enroll

- Special Enrollment Information

-

-

For Members

show For Members menu

-

- Pay Now

- Find a Doctor

- Drug Coverage

- Forms and Materials

- Ways to Pay

- New Members

- Renew Your Plan

- Better Health Center

- The Better Bulletin

- Member News

- Health Savings Account

Find everything you need in the member online account

- View your claims

- Review your plan benefits

- Print your ID card

- View rewards points total

-

Tennessee Health Plan Options | Ambetter

Plan Options

For a fully keyboard-accessible alternative to this video, view it in Chrome or on any Android or iOS device, view it in Firefox with the YouTube ALL HTML5 add-on installed, or disable Flash in Internet Explorer.

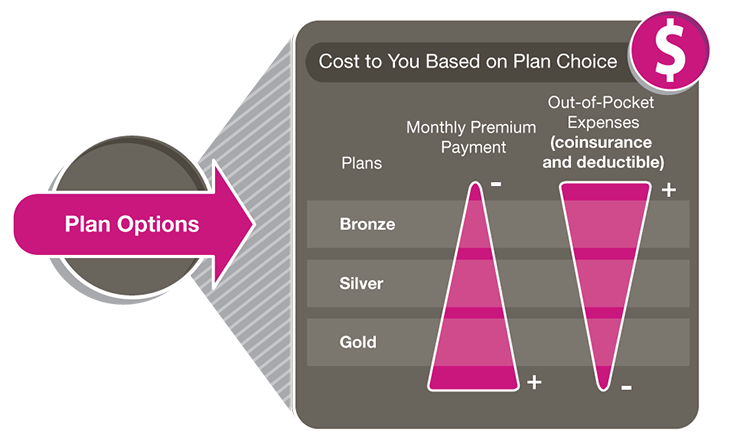

When you begin shopping for a Marketplace health plan, you’ll see plan options with different metal tiers such as Gold, Silver and Bronze plans. But the only difference between these plans is how much premium you’ll pay each month and how much you’ll pay for certain medical services.

A Bronze plan typically gives you lower monthly premium payments, but potentially higher out-of-pocket costs – if you end up needing a lot of care. And a Gold plan may have higher monthly premiums, but that helps you limit your out-of-pocket costs later.

If you’re looking for a balance on your monthly premium payments and your out-of-pocket costs, Silver plans provide just that. And, Silver plans are the only plans with additional out-of-pocket payment reductions (cost sharing reductions)! This helps lower the costs of your copays, deductibles and coinsurance.

So, if you are eligible for a subsidy and cost sharing, Silver plans offer the highest value.

Remember, your Essential Health Benefits are covered and will be equal across all plans.

Remember, your Essential Health Benefits are covered and will be equal across all plans.

The information above represents the way typical plans at each metal level work. How much you pay will depend on your specific plan.